What is Scalping?

In short, scalping is the idea of taking quick trades (typically on smaller time frames) that only need to go a short distance before you cash out of the position and then to do this many times over. Whether you are talking about pennies, points, pips or ticks, the idea is the same: Scalpers are not looking for a long term moves or to catch a sizable portion of the trend. We simply want to grab a small profit and move on to the next opportunity. In this report, I will give you a step by step set of instructions for utilizing The Lazy River Scalping Strategy my favorite scalping method. My goal is that you’ll be able to utilize this strategy by the time you finish reading this report. As always, I recommend testing it out and getting comfortable on a practice account or a very small account and making any edits or tweaks to the strategy so that it fits your style.

Step 1: Setting up the chart

I like to use a very simple setup for most of my strategies and this one is no different. As you’ll note, it is just a few steps and VERY basic indicators.

That’s it, the chart is set in three simple steps and we are ready to move ahead.

Step 2: Identifying the trend

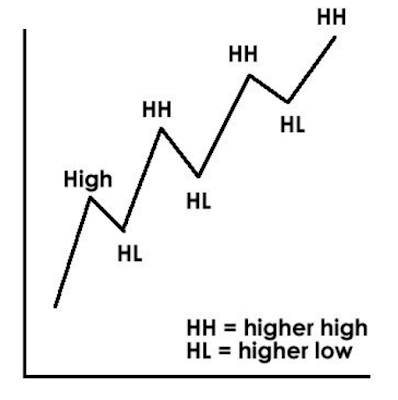

Every trader should learn that the ‘Trend is your friend’, early on. Any time you can utilize this principle as an edge in your trading, you should. It’s often easy to lose focus of something as simple as watching out for the trend, so in the Lazy River, we make sure we identify it before even thinking about making an entry.

Uptrend Criteria

- Price should be above both the 20 and 50 EMA.

- 20 EMA should be above 50 EMA

- Both 20 and 50 EMA should be curving upwards

- The moving averages should not crisscross each other frequently. 20 EMA should be comfortably above the 50 EMA.

- If all the above conditions are fulfilled, it confirms that the pair is in an uptrend and we can look for opportunities to go long on the pair

Example of Bullish Trend:

|

| Bullish Uptrend Candlestick chart |

Downtrend Criteria

- Price should be below the 20 and 50 EMA

- 20 EMA should be below the 50 EMA

- Both the moving averages should be turning down.

- The moving averages should not crisscross each other frequently. 20 EMA should be comfortably below the 50 EMA.

- If the above conditions are fulfilled, the pair is in a downtrend, and we can look for opportunities to short the pair.

Example of Bearish Trend:

|

| Bearish Downtrend Candlestick chart |