MACD Trend Following Strategy

Step #5: Take Profit when the MACD crossover happens in the opposite direction of our entry

Knowing when to take profit is as important as knowing when to enter a trade. However, we

want to make sure we don’t use the same trading technique as for our entry order. When the

MACD line (the blue line) crosses the signal line (the orange line) we want to close the position

and take full profits.

|

| When to take profit |

Before taking profits, it’s important to wait for the candle close – either the 4h or the daily

candle – depending on the time frame you trade so you make sure the MACD crossover actually

happens.

Note** The above was an example of a buy trade using the MACD Trend Following Strategy. Use the exact same rules – but in reverse – for a sell trade. In the figure below you can see an actual SELL trade example using the MACD Trend Following Strategy.

Take a look:

|

| Shorting using MACD |

We’ve applied the same Step #1 and Step#2 to help us draw the trendline and followed Step #3

to trigger our trade.

Conclusion:

The MACD Trend Following Strategy is a very simple trend following strategy and yet a very

profitable strategy at the same time.

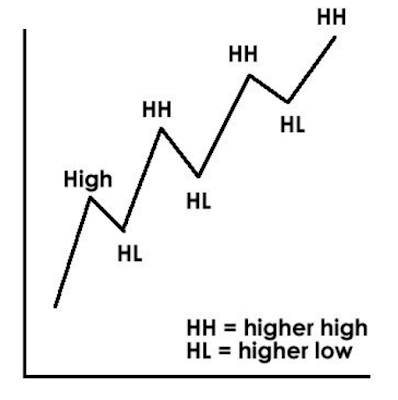

As the saying goes, “The trend is your friend” and no matter if you’re just starting as a Forex trader or you’re already an established trader life is much easier when trading in the direction of the line of least resistance rather than fighting the trend which is a loser's game.

The success behind the MACD Trend Following Strategy is derived from one simple principle: momentum precedes price.